Ads

Personal loans can be powerful financial tools when used wisely. Whether you need to fund a home improvement project, consolidate debt, cover a major expense, or plan a dream wedding, choosing the right loan can save you money and stress. But with so many options available in the UK, how do you pick the best one?

In this comprehensive guide, we’ll explore five of the most popular and reliable personal loan providers in the United Kingdom:

- HSBC Personal Loan;

- Admiral Unsecured Personal Loan;

- Zopa Personal Loan;

- Novuna Personal Loan;

- NatWest Personal Loan.

For each option, we’ll provide a clear breakdown of what they offer, the amounts you can borrow, applicable rates and fees, terms, application conditions, and a step-by-step on how to apply. Plus, we’ll list key advantages and drawbacks to help you make an informed decision.

Ads

1. HSBC Personal Loan

HSBC is a global bank with a trusted presence in the UK, offering personal loans with competitive rates and flexible terms. It’s ideal for individuals seeking a reliable lender with a strong reputation and digital convenience.

You will remain on the same website.

Loan Amounts

- Minimum: £1,000

- Maximum: £25,000 (up to £50,000 for existing customers)

Rates and Fees

- Representative APR: From 6.1% (fixed)

- No arrangement or early repayment fees

Terms

- Repayment term: 1 to 8 years

Conditions to Apply

- Must be over 18 and a UK resident

- Good credit score recommended

- Stable income required

- Existing customers may receive better offers

How to Apply

- Apply online through the HSBC website

- Instant decision for most applicants

Advantages

- Low representative APR

- No hidden fees

- Existing HSBC customers can borrow more

Disadvantages

- Strict credit checks

- Better rates may require a high credit score

You will remain on the same website.

2. Admiral Unsecured Personal Loan

Known mainly for its car insurance, Admiral also provides personal loans with competitive interest rates. Their unsecured loans can be used for a range of purposes, including debt consolidation and home upgrades.

You will remain on the same website.

Loan Amounts

- Minimum: £1,000

- Maximum: £25,000

Rates and Fees

- Representative APR: From 6.9%

- No setup or early repayment charges

Terms

- Repayment term: 1 to 5 years

Conditions to Apply

- Aged 18 or over

- UK residency

- Must have a UK bank account and a good credit history

How to Apply

- Start the process at Admiral’s website

- Quick and straightforward online form

Advantages

- Transparent pricing

- No early repayment penalties

- Quick decision process

Disadvantages

- Shorter repayment term range than some competitors

- Top rates reserved for excellent credit profiles

You will remain on the same website.

3. Zopa Personal Loan

Zopa is one of the UK’s first digital lenders, originally a peer-to-peer platform. Today, it offers fully regulated personal loans with excellent digital features and competitive rates.

You will remain on the same website.

Loan Amounts

- Minimum: £1,000

- Maximum: £25,000 (up to £50,000 in some cases)

Rates and Fees

- Representative APR: From 7.9%

- No hidden fees or early repayment charges

Terms

- Repayment term: 1 to 5 years

Conditions to Apply

- UK resident

- 20+ years old

- Minimum income requirement applies

- Must have a good to excellent credit score

How to Apply

- Apply online via Zopa’s website

- Fast eligibility checker without affecting your credit score

Advantages

- Easy to use app and platform

- Quick approval

- Competitive fixed rates

Disadvantages

- Not ideal for borrowers with low credit scores

- Higher APRs for smaller amounts

You will remain on the same website.

4. Novuna Personal Loan

Novuna Personal Finance (formerly Hitachi Capital) offers loans known for their flexibility and low rates, particularly attractive for those with strong credit.

You will remain on the same website.

Loan Amounts

- Minimum: £1,000

- Maximum: £35,000

Rates and Fees

- Representative APR: From 7.4%

- No upfront fees or early repayment penalties

Terms

- Repayment term: 2 to 7 years

Conditions to Apply

- Must be a UK resident aged 21+

- Must have a UK bank account and steady income

How to Apply

- Apply online via Novuna’s website

- Pre-check eligibility with soft search tools

Advantages

- Competitive fixed interest rates

- Flexible loan terms

- Fast decisions

Disadvantages

- Only available to those with good credit

- Limited customer service availability on weekends

You will remain on the same website.

5. NatWest Personal Loan

NatWest offers personal loans with flexible borrowing limits and tailored rates for existing customers, making it a solid choice for those already banking with NatWest.

You will remain on the same website.

Loan Amounts

- Minimum: £1,000

- Maximum: £50,000

Rates and Fees

- Representative APR: From 6.9%

- No arrangement or early repayment fees

Terms

- Repayment term: 1 to 8 years

Conditions to Apply

- UK resident, 18 or older

- Must hold a NatWest current account for best rates

- Good credit score required

How to Apply

- Apply online at NatWest’s website

- Use eligibility checker to avoid impact on credit score

Advantages

- High maximum loan amount

- Favourable terms for existing customers

- No fees or penalties

Disadvantages

- Lower borrowing limits for new customers

- Rates may vary based on profile

You will remain on the same website.

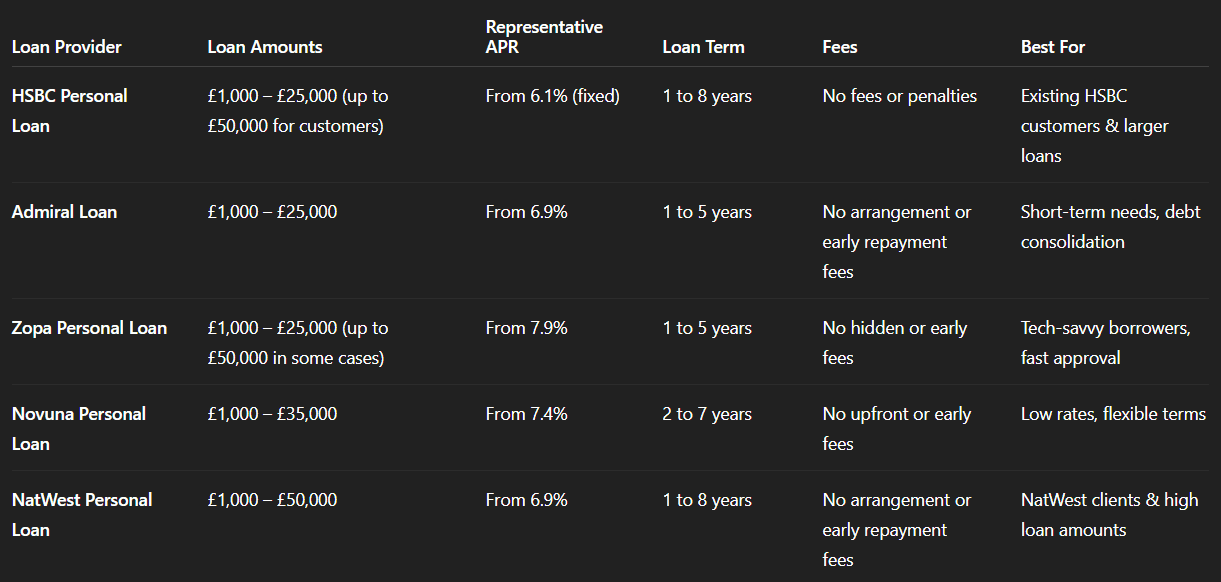

Comparative Table – Top 5 Personal Loans in the UK

Conclusion

Personal loans can offer the flexibility and financial support needed to manage life's expenses. But finding the right one requires understanding what each lender offers and matching it to your needs and financial profile.

Here's a quick recap:

- HSBC: Best for trusted name, higher limits for existing clients

- Admiral: Great for simple, short-term borrowing

- Zopa: Perfect for digital-savvy borrowers who want speed and transparency

- Novuna: Excellent rates for good-credit customers

- NatWest: Ideal for loyal customers with long-term borrowing needs

When comparing loans, remember to:

- Always check your eligibility with soft search tools

- Read the small print regarding APRs and conditions

- Consider total repayment costs, not just the monthly payments

- Ensure the loan term suits your financial goals

Use the information in this guide to confidently choose a loan that works for your situation. And above all, borrow responsibly.

If you need help calculating monthly repayments or comparing loans side-by-side, consider using a reputable UK loan calculator tool.

You will remain on the same website.