Ads

Personal loans can be powerful financial tools, but choosing the right one in a crowded market can feel overwhelming. Whether you're planning a major home renovation, consolidating debt into one manageable payment, or funding a dream wedding, the lender you pick can save you thousands and eliminate stress.

So, how do you cut through the noise?

We’ve done the hard work for you. This comprehensive guide reviews five of the UK's most popular and reliable personal loan providers, giving you the clarity you need to make a smart decision.

- HSBC Personal Loan

- Admiral Unsecured Personal Loan

- Zopa Personal Loan

- Novuna Personal Loan

- NatWest Personal Loan

For each lender, we’ll break down exactly what they offer—from loan amounts and interest rates to application requirements and unique perks. Let’s find the perfect loan for your goals.

1. HSBC Personal Loan

Best for reliability and higher limits for existing customers.

HSBC is a global banking giant offering highly competitive rates and the security of a trusted brand. It's an excellent choice for borrowers who value a straightforward digital process backed by a long-standing reputation.

You will remain on the same website.

Loan Amounts: £1,000 to £25,000 (up to £50,000 for current HSBC customers).

Rates and Fees: Representative APR from 6.1% (fixed). No arrangement or early repayment fees.

Terms: 1 to 8 years.

Conditions to Apply: Must be a UK resident aged 18+. A stable income and a good credit score are essential.

How to Apply: A simple online application with an instant decision for most people.

Advantages: Very competitive representative APR, no hidden fees, and higher borrowing limits for loyal customers.

Disadvantages: Requires a strong credit history, and the best rates are reserved for those with excellent scores.

You will remain on the same website.

2. Admiral Unsecured Personal Loan

A strong contender for simple, transparent borrowing.

Primarily known for insurance, Admiral brings its reputation for clear pricing and simplicity to the loan market. It’s a fantastic option for those who want a no-fuss loan for things like car purchases or debt consolidation.

You will remain on the same website.

Loan Amounts: £1,000 to £25,000.

Rates and Fees: Representative APR from 6.9%. No setup fees or early repayment penalties.

Terms: 1 to 5 years.

Conditions to Apply: Must be a UK resident aged 18+ with a UK bank account and a solid credit history.

How to Apply: Quick and straightforward online form on the Admiral website.

Advantages: Transparent pricing with no surprises, penalty-free overpayments, and a fast decision process.

Disadvantages: The maximum repayment term is shorter than some competitors.

You will remain on the same website.

3. Zopa Personal Loan

The top choice for a fast, digital-first experience.

As a pioneering digital lender, Zopa offers a seamless online experience from start to finish. It’s perfect for tech-savvy borrowers who value speed, a great mobile app, and competitive fixed rates.

You will remain on the same website.

Loan Amounts: £1,000 to £25,000 (potentially up to £50,000).

Rates and Fees: Representative APR from 7.9%. No hidden fees or early repayment charges.

Terms: 1 to 5 years.

Conditions to Apply: Must be a UK resident aged 20+ with a steady income and a good to excellent credit score.

How to Apply: Use the fast eligibility checker (no credit score impact) on Zopa’s website.

Advantages: User-friendly app and platform, quick approval and funding, and competitive fixed rates.

Disadvantages: Not suitable for borrowers with poor credit history.

You will remain on the same website.

4. Novuna Personal Loan

Excellent rates for borrowers with a strong credit history.

Novuna (formerly Hitachi Capital) has earned multiple awards for its personal loans, known for offering some of the market's most competitive rates to customers with good credit.

You will remain on the same website.

Loan Amounts: £1,000 to £35,000.

Rates and Fees: Representative APR from 7.4%. No upfront fees or penalties for early repayment.

Terms: 2 to 7 years.

Conditions to Apply: Must be a UK resident aged 21+ with a UK bank account and a reliable income.

How to Apply: Check your eligibility with a soft search on Novuna’s website before applying online.

Advantages: Consistently competitive fixed rates, flexible loan terms, and fast decisions.

Disadvantages: Primarily aimed at those with a strong credit profile.

You will remain on the same website.

5. NatWest Personal Loan

Ideal for loyal customers seeking high loan amounts.

NatWest provides a solid all-around loan, but it truly shines for its existing customers, who can access higher borrowing limits and potentially better rates. It's a great choice for significant expenses.

You will remain on the same website.

Loan Amounts: £1,000 to £50,000.

Rates and Fees: Representative APR from 6.9%. No arrangement or early repayment fees.

Terms: 1 to 8 years.

Conditions to Apply: Must be a UK resident aged 18+ with a good credit score. Holding a NatWest current account is key for the best offers.

How to Apply: Use the eligibility checker on the NatWest website to see your likely rate without impacting your credit score.

Advantages: High maximum loan amount, favourable terms for existing customers, and no hidden fees.

Disadvantages: New customers may face lower borrowing limits and less competitive rates.

You will remain on the same website.

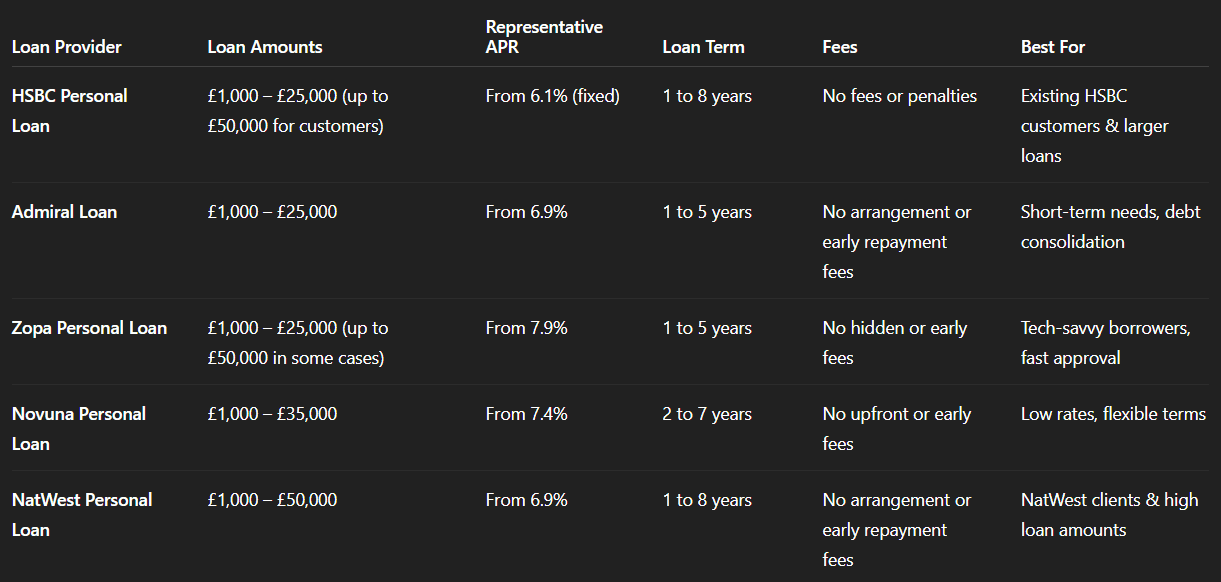

Comparative Table – Top 5 Personal Loans in the UK

Conclusion: Making Your Choice

Choosing the right personal loan comes down to matching the lender’s strengths to your personal and financial circumstances.

Here’s a quick summary:

- HSBC: Best for trust, reputation, and perks for existing customers.

- Admiral: Best for simple, no-fuss borrowing with transparent terms.

- Zopa: Best for a fast, modern, and fully digital loan experience.

- Novuna: Best for low rates if you have a strong credit history.

- NatWest: Best for high borrowing needs, especially if you're already a customer.

Before you apply, always remember to:

- Check Your Eligibility First: Use "soft search" tools to see your likely rate without harming your credit score.

- Understand the APR: The representative APR is what at least 51% of approved applicants get; your rate could be different.

- Calculate the Total Cost: Look beyond the monthly payment to see the total amount you’ll repay over the loan’s lifetime.

Armed with this information, you’re now ready to confidently choose the loan that best fits your financial journey. Borrow wisely!

You will remain on the same website.